The amount of depreciation taken in each accounting period is based on a predetermined schedule using either a straight line method or one of a number of accelerated depreciation methods. Loss is the amount by which expenses exceed revenues within a given accounting period. It indicates that a company has spent more money than it has earned during that time frame. At the end of the day, shareholders bear the ultimate risk for a company’s financial losses.

Financial Analysis and Decision Making

- A loss recognized when the carrying value of an asset exceeds its recoverable amount, indicating that the asset has been impaired and its value has declined.

- It’s just as important to know when to recognize a loss as it is to recognize income.

- Revenue or sales is the total amount earned from selling goods or services before any costs or expenses are deducted.

- Most companies report items such as revenues, gains, expenses, and losses on their income statements.

Revenue losses appear in the income statement of the year in which they occur. Periodically evaluating the value of assets helps a company accurately record its asset value rather than overstating its asset value, which could lead to financial problems later on. As part of the same entry, a $50,000 credit is also made to the building’s asset account, to reduce the asset’s balance, or to another balance sheet account called the “Provision for Impairment Losses.” Certain assets, such as intangible goodwill, must be tested for impairment on an annual basis in order to ensure that the value of assets is not inflated on the balance sheet. Depreciation schedules allow for a set distribution of the reduction of an asset’s value over its lifetime, unlike impairment, which accounts for an unusual and drastic drop in the fair value of an asset. Impairment is most commonly used to describe a drastic reduction in the recoverable value of a fixed asset.

Example of Impairment

The impairment may be caused by a change in the company’s legal or economic circumstances or by a casualty loss from an unforeseeable disaster. After all deductions, including taxes, the remaining amount represents the company’s net profit. This is the money before the taxman takes his share, and it offers a clear picture of profitability from operations and secondary activities combined.

Ignores Cash Flow and Timing

Impairment refers to the reduction in the value of a company asset, either a fixed asset or an intangible asset. The Profit and Loss Statement (P&L) serves as a comprehensive financial snapshot, encapsulating a company’s revenue, expenses, and overall profitability over a specific period. By separating operational and non-operational revenues and expenses, it provides a more nuanced snapshot of a business’s health. If the tech sector experiences a downturn due to new legislation or market saturation, the value of those shares could decrease, resulting in a financial loss for the investor. Similarly, a sudden increase in the interest rates set by the central bank can lead to lower spending in the economy, which can negatively affect a business’s bottom line. This financial flexibility makes them integral tools in corporate tax planning.

Get in Touch With a Financial Advisor

Analyzing these trends offers foresight, allowing businesses to adapt, evolve, and innovate. The P&L statement, for all its details, can’t capture non-financial factors. Employee morale, brand reputation, or customer satisfaction don’t find a mention here. Decision-making in business is a blend of intuition and cold, hard data. Analysts pore over it, extracting insights, drawing parallels, and forecasting trends. No earnings report is complete without acknowledging the slice that goes to the government.

Do you already work with a financial advisor?

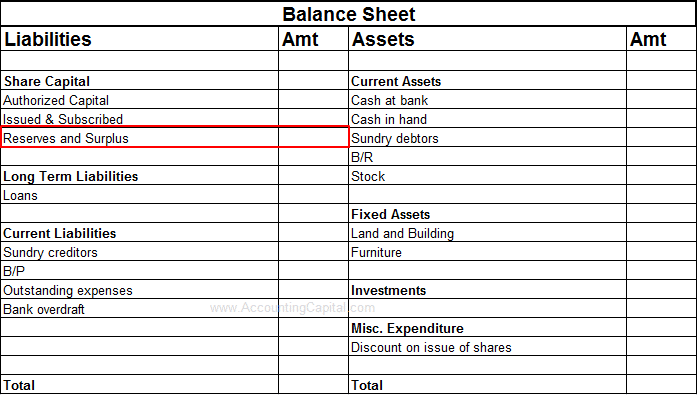

Along with the balance sheet and statement of cash flows, the P&L is one of the three core financial documents that measure company performance. Alongside the balance sheet and cash flow statement, it is one of the three core financial documents that measure company performance. When evaluating a profit and loss statement, it is important to consider statements from previous periods to get a more accurate sense of the rate of change in a company’s revenues and expenses. Along with the balance sheet and statement of cash flows, it is one of the three core financial documents that measure company performance. The indirect effect of financial losses is a drop in investor confidence. While one poor financial performance might not shake the confidence of investors, consistent losses over a period of time can.

Perhaps the clearest way to delineate gains and losses from revenues and expenses is their role in how a business functions. Unlike gains and losses, revenues and expenses are not opposite financial results of the same activities. Investors and analysts will typically give far more weight to these metrics than losses or gains. Extraordinary losses are those not incurred in the ordinary course of business and, generally, are infrequent and unusual.

Another example would be if Company A has $200,000 in sales, $140,000 in COGS, and $80,000 in expenses. Subtracting $140,000 COGS from $200,000 in sales results in $60,000 in gross profit. However, because expenses exceed gross profit, a $20,000 net loss results. Revenues and expenses for nonprofit organizations are generally tracked in a financial report called the statement of activities.

The quadratic loss function is also used in linear-quadratic optimal control problems. In these problems, even in the absence of uncertainty, it may not be possible to achieve the desired values of all target variables. Often loss is expressed as a quadratic form in the deviations of the variables of interest from their desired values; this approach is tractable because it results in linear first-order conditions. In the context of stochastic control, the expected value of the quadratic form is used. Costs that are necessary for a company to conduct its primary business activities, such as wages, rent, and utilities.

Regulatory bodies have the power to issue substantial penalties for non-compliance. These fines can vary drastically, but in some cases, they can be large enough to threaten a company’s financial stability. Apart from market uncertainty, individual businesses face their own set of business-specific risks. These could range from operational risks, like a breakdown in manufacturing machinery, to strategic risks, such as entry into a new market. It allows corporations to apply a net operating loss to past tax returns, thereby potentially securing a refund for previously paid taxes.

Below, we’ll take a look at each combination of terms and how they can differ. Ultimately, businesses look to maximize gains and revenues while minimizing expenses and losses. Yes, even if a company has a large volume of sales, it can still end up losing money sales returns and allowances recording returns in your books if the cost of goods or other expenses related to those sales (e.g., marketing) are too high. Other factors like taxes, interest expenses, depreciation and amortization, and one-time charges like a lawsuit can also take a company from a profit to a net loss.