The hybrid method can be complex, so only use it if it is required or if you have some accounting skills. If you aren’t skilled in accounting, speak with a CPA for assistance and read IRS Publication 538. If accrual-basis accounting doesn’t measure how much cash is physically in your bank account, how is it more accurate than the cash method? Because instead of hyper-focusing on the exact time a transaction occurred, it focuses on what you earned and what you owed in a given period. The US government uses a set of generally accepted accounting principles, or GAAP, to regulate how certain companies file financial documents.

Accrual Accounting vs. Cash Basis Accounting: An Overview

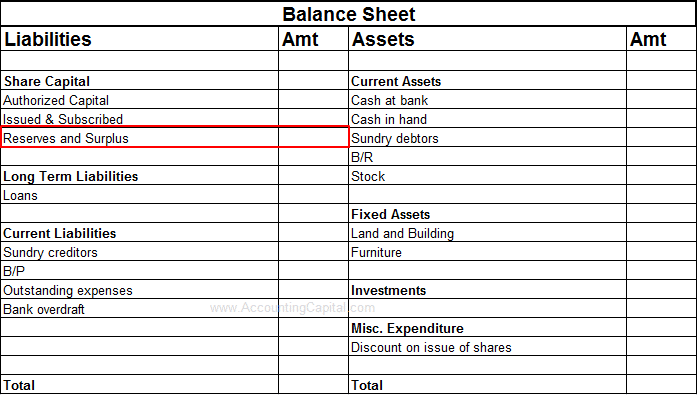

There are logical reasons, such as company size and budget, that master budget might lead a business to prefer one system over the other. If you are unsure which approach is best for your business, it may be a good idea to seek professional advice to determine if your company should use cash or accrual accounting. Businesses using the accrual method to keep an accurate picture of accounts payable and receivable will maintain their ledgers according to the current status of a bill or invoice.

The cash method is best for small service businesses with low inventory, while the accrual method of accounting is best for large businesses with complex practices. A simple cash accounting method does not acknowledge or track accounts receivable or accounts payable. For example, if you provide a business service in December, but you don’t collect payment until January, you record the revenue and payment in January.

A company buys $700 of office supplies in March, which it pays for in April. With the cash basis method, the company recognizes the purchase in April, when it pays the flexible budget formula bill. Whereas with the accrual basis accounting, the company recognizes the purchase in March, when it received the supplier invoice. The cash basis of accounting recognizes revenues when cash is received, and expenses when they are paid.

This used to be how your nonprofit can succeed with cause marketing done by hand on paper, but now business owners mainly do this using bookkeeping software. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. Under the accrual method, the $5,000 is recorded as revenue as of the day the sale was made, though you may receive the money a few days, weeks, or even months later.

What Is the Difference Between Cash Accounting and Accrual Accounting?

Though the cash-basis accounting technique has advantages, there are notable setbacks. Choosing the right accounting method requires understanding their core differences. Accrual accounting is encouraged by International Financial Reporting Standards(IFRS) and Generally Accepted Accounting Principles (GAAP). As a result, it has become the standard accounting practice for most companies except for very small businesses and individuals. In other words, if you have a small stationery business that purchased paper supplies on credit in June, but didn’t actually pay the bill until July, you would record those supplies as a July expense. We believe everyone should be able to make financial decisions with confidence.

- Cash and accrual accounting are both methods for recording business transactions.

- We’ll explain the basics of the cash accounting and accrual accounting methods, as well as the pros and cons of each so that you can make an informed decision.

- Although, accrual method is the most commonly used by companies, especially publicly traded companies.

- Accrual accounting is an accounting method in which payments and expenses are credited and debited when earned or incurred.

- Because this method gives you a more complete picture of your business’s finances, it’s more commonly used than the cash method.

How Accrual Accounting Works

As long as your sales are less than $25 million per year, you’re free to use either the cash basis accounting or accrual method of accounting. Cash accounting records income and expenses as they are billed and paid. With accrual accounting, you record income and expenses as they are billed and earned. While some business owners are free to choose the type of accounting method they want to use, others aren’t.

What Is the Difference Between Cash Basis and Accrual Accounting?

The cash basis method records these only when cash changes hands and can present more frequently changing views of profitability. The accrual method is the more commonly used method, particularly by publicly traded companies. One reason for the accrual method’s popularity is that it smooths out earnings over time since it accounts for all revenues and expenses as they’re generated.

Business News Daily provides resources, advice and product reviews to drive business growth. Our mission is to equip business owners with the knowledge and confidence to make informed decisions. Because this method gives you a more complete picture of your business’s finances, it’s more commonly used than the cash method.